Working overseas in Japan could also mean that you are familiar with the types of insurance that you usually pay every month, such as National Pension. This insurance scheme obliged Japanese and those working foreign nationals to subscribe to the monthly premium. But you may ask, why do I have to pay the monthly contribution where I have no plan to retire in this country? In this article, you will learn more about National Pension, particularly on how to claim the lump-sum withdrawal payments.

What is the National Pension?

The National Pension or Kokumin Nenkin (国民年金) is a government-managed pension system, which provides basic benefits due to old age, disability, and death. This is managed by Japan Pension Service, which is responsible for pension operations and MHLW for financial and administrative responsibility.

All registered residents in Japan, Japanese or foreign nationals – aged 20 to 59, employed or not, are required to enroll for the National Pension plan. This pension scheme is mandatory to all nevertheless you are paying for other premiums, such as kosei nenkin, or employee’s pension insurance plan (厚生年金) – a subscription plan for those employed in the company.

In addition, the insurance premiums you paid support the lives of the elderly, who are currently receiving pensions.

The 3 Types of Subscriber

| Category | Subscriber |

| First | Self-employed, agriculture, forestry and fisheries, freelance work, part-time workers, students, unemployed people aged 20 to under 60 |

| Second | Company employees, public servants, etc. who are enrolled in welfare pensions, mutual aid associations, etc. |

| Third | A wife (husband) who is dependent on a welfare pension or a mutual aid association who is between 20 and 60 years old. |

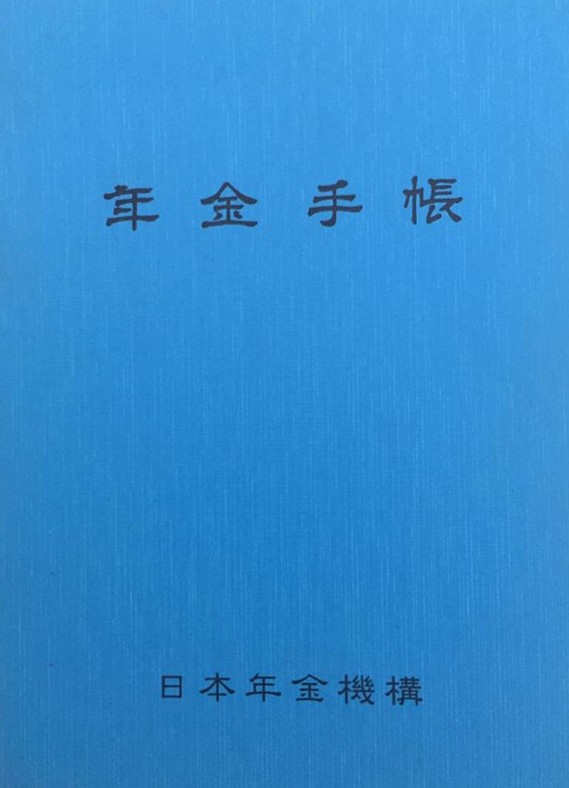

Once you subscribed to the national pension, you will receive a pension handbook. This blue colored book has a social security number that serves as proof of identity, which is one of the requirements when claiming for the lump-sum payment. It is important not to misplace it. However, in the event you lost the handbook, you can request a replacement copy.

Once you subscribed to the national pension, you will receive a pension handbook. This blue colored book has a social security number that serves as proof of identity, which is one of the requirements when claiming for the lump-sum payment. It is important not to misplace it. However, in the event you lost the handbook, you can request a replacement copy.

How much is the cost of National Pension?

The flat-rate contribution per month for the National Pension is ¥16,540 (for the fiscal year 2020).

Where to pay?

You can pay at banks, post offices, agricultural cooperatives, fisheries cooperatives, credit unions, labor unions, credit unions, and convenience stores depending on what is stated on the payment slip received from the Japan Pension Service.

*Early bird discount of ¥50, once transferred contribution by the end of the current month by direct debit.

Please watch more videos on our YouTube channel, here.

Lump-Sum Withdrawal Payments

Getting a refund of what you have contributed from the National Pension in Japan is permitted. This option is for those foreign workers who completed their contracts and no longer have a registered address in Japan. They can recover for up to three (3) years of pension payments.

How much lump-sum can you take from your national pension?

You will only get 80% of the total contribution and the remaining 20% is for withholding income tax.

The 20% percent deducted from the income tax is also refundable, considering that you are no longer a resident of Japan. It’s up to you if you want to process the refund or not. But if you’ll do, then your appointed trusted friend in Japan, who will serve as your tax representative will process it on your behalf and will receive the tax refund.

How to claim the tax refund?

- Download the tax agent designation form (SHOTOKUZEI SHOHIZEI NO NOZEI KANRININ NO TODOKEDESHO)

- Fill out the form and print two copies

- Submit the copies to your local tax office, which covers your last address in Japan.

- After they stamped both copies, they will return one copy to you and take the other one. You will then give it to your designated tax representative.

- Once the lump-sum deposited in your bank account you will also receive the notice of lump-sum withdrawal payment via airmail, declaring the amount and the income tax amount. Send the original notice to your tax representative in Japan.

- She/He will then file a tax refund claim at the local tax office, attaching the received notice.

Lump-Sum Payment Amount

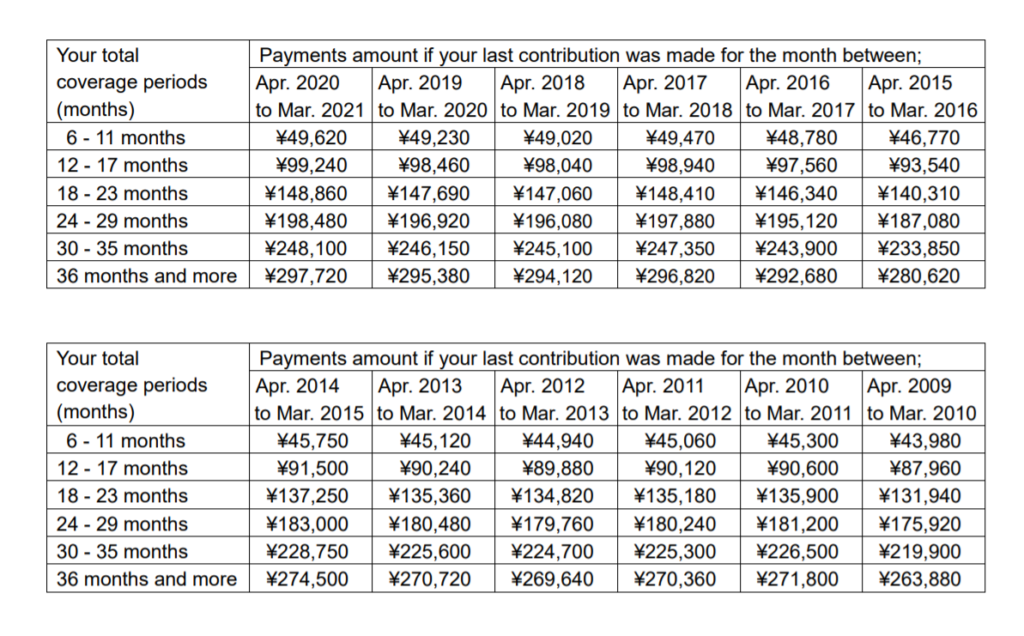

You should file your application for the Lump-sum Withdrawal Payments within two (2) years after you leave in Japan and you no longer have registered address in Japan. How much is the lump-sum payment amount?

The lump-sum payment amount will depend on the final contribution-paid month in the fiscal year 2020 and before April 2020. Please refer to the table below.

Resource: https://www.nenkin.go.jp/

Who is eligible to apply for the lump-sum withdrawal?

- You are a non-Japanese

- You have paid the monthly premiums for 6 months or more

- No longer have an address in Japan

- Never been entitled to Japanese public pension benefits including Disability Allowance.

To cancel your registered address in Japan, you must notify the city or ward office by filing a notice of moving out (leaving Japan).

Documents Required

- Bring your Pension Handbook or other documents having your Basic Pension Number

- Provide a photocopy of your passport, the page(s) showing your name, date of birth, nationality, signature, and status of residence (e.g. engineer or professor).

- Certified copy of “JOHYO” – a resident registry issued at your municipal office declaring your deleted residence record.

*You do not need to submit this evidence document if you report to your municipal office that you will reside outside of Japan before you leave Japan. The municipal offices and the Japan Pension Service share necessary evidence information to confirm that you no longer have registered address in Japan.

- Documents issued by your bank, such as bank’s certificate or passbook, void check, etc. showing that you are the account holder, including the bank’s name, address of branch office, and bank account number.

*Instead of documents, you may have your bank verify your account details and stamp on the column “Bank Stamp for verification” on the application form. You may nominate the bank in Japan, as far as your account name is registered in Japanese KATAKANA letters. Please note you cannot receive your Payments at Japan Post bank (YUUCHO GINKO).

National Pension provides a basic pension when you retire. However, choosing the lump-sum withdrawal payment option will forfeit the pension coverage in the future. Nevertheless, you’re a foreign worker who will stay only five (5) years or less in Japan. Applying for the lump-sum claim is the only way to take back what you have contributed during the period you worked abroad in Japan.

If you want to know about Social Insurance in Japan, please read the “What is Social Insurance in Japan?” article.

日本語

日本語